Money Back Guarantee:

A standard money back guarantee addresses which items or services the guarantee applies to and the timeframe for returns.

Below, I explain if your certificate safety clearance needs a money back guarantee, what should be included in this policy, and how to easily make one.

•Money back guarantees allow customers to return purchases for full refunds.

A money back guarantee is a type of return policy that lets consumers know they can return a certificate safety clearance and get their money back if they’re dissatisfied.

Typically, only certain certificate safety clearance are eligible for a money back guarantee, which should be marked in-store and on any digital pages and listed in full in the policy itself.

Some businesses limit the timeframe for accepting returns for the money back guarantee.

The policy may also be a temporary promotion to attract new customers, and you are typically legally allowed to impose a deadline.

All of these relevant terms regarding the return process should be listed in your money back guarantee policy.

What To Include in a Money Back Guarantee

Next, I’ll walk you through the three basic parts of a money back guarantee.

Returns Process and Timeframe

You should address the returns process and timeline in your money back guarantee policy.

Start by answering the following questions:

- Does the process need to be completed to receive a refund?

- How many days does it take for the customer to complete the process?

- Do the days start counting from the time of purchase or the time the Certificate Safety Clearance is received?

- Can the deadline be extended in any way?

- Does the customer need to provide a reason or justification for why they are returning the Certificate of Safety Clearance?

Then, incorporate your answers into the details of your final policy.

You can set any terms you want, within reason, as long as you communicate this to customers.

What is a proof of payment

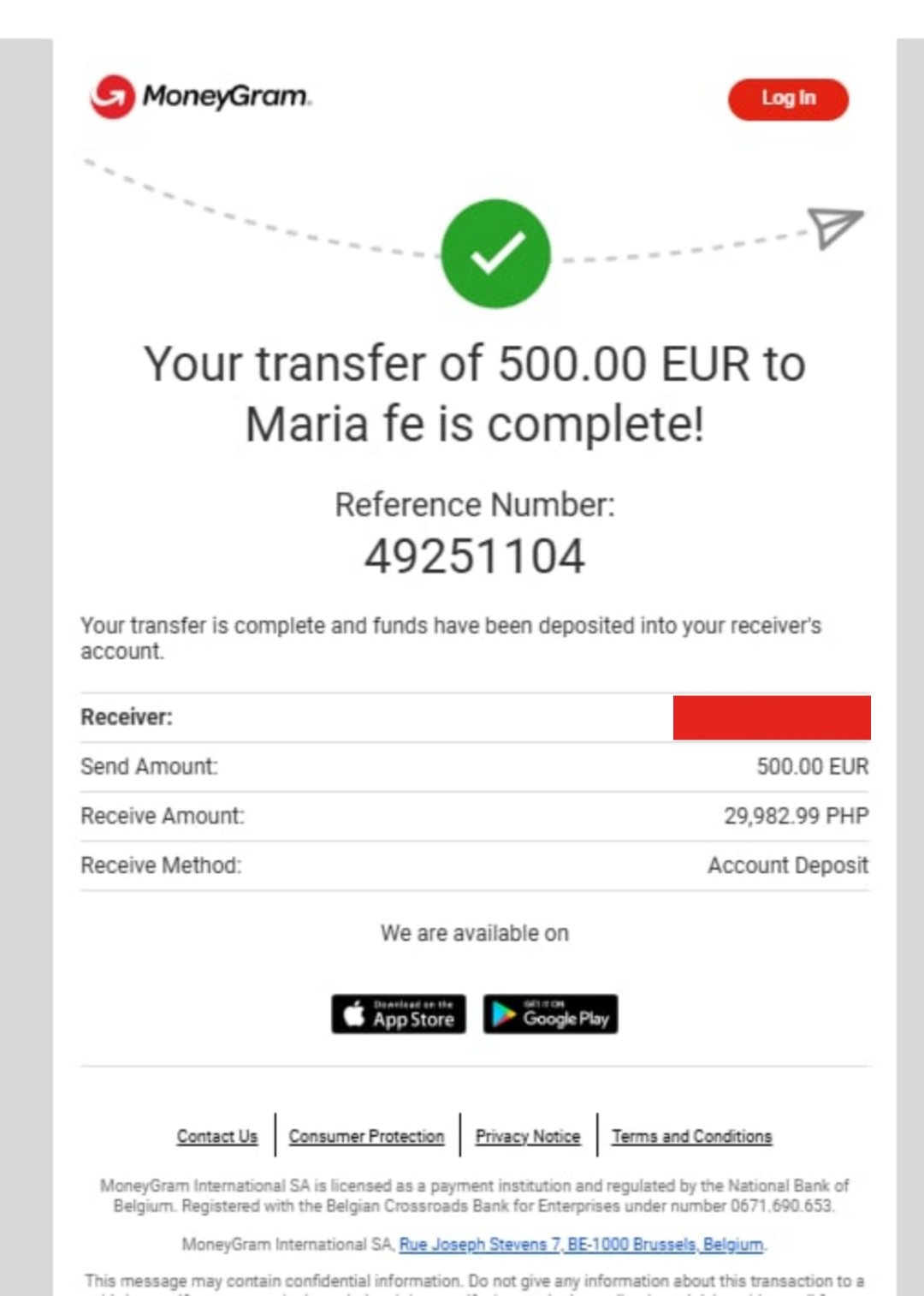

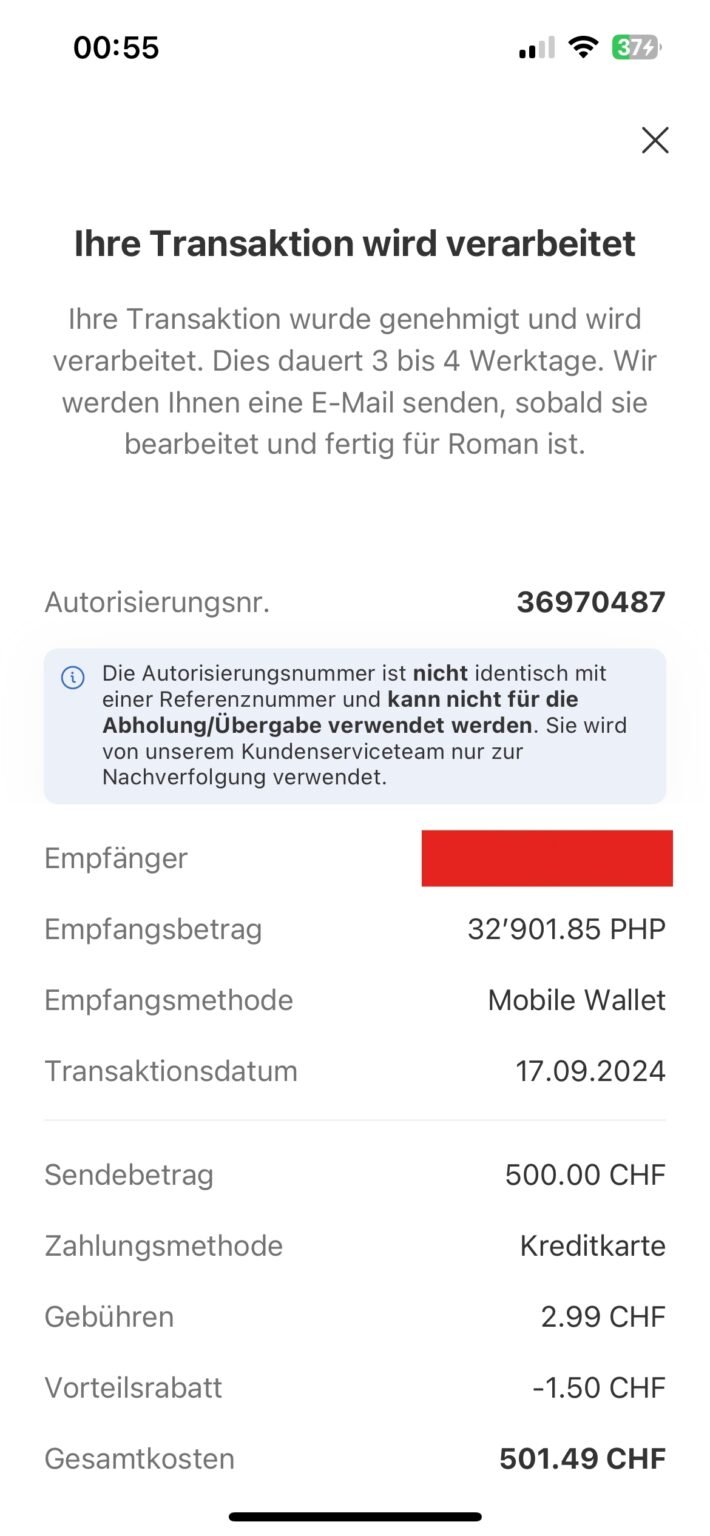

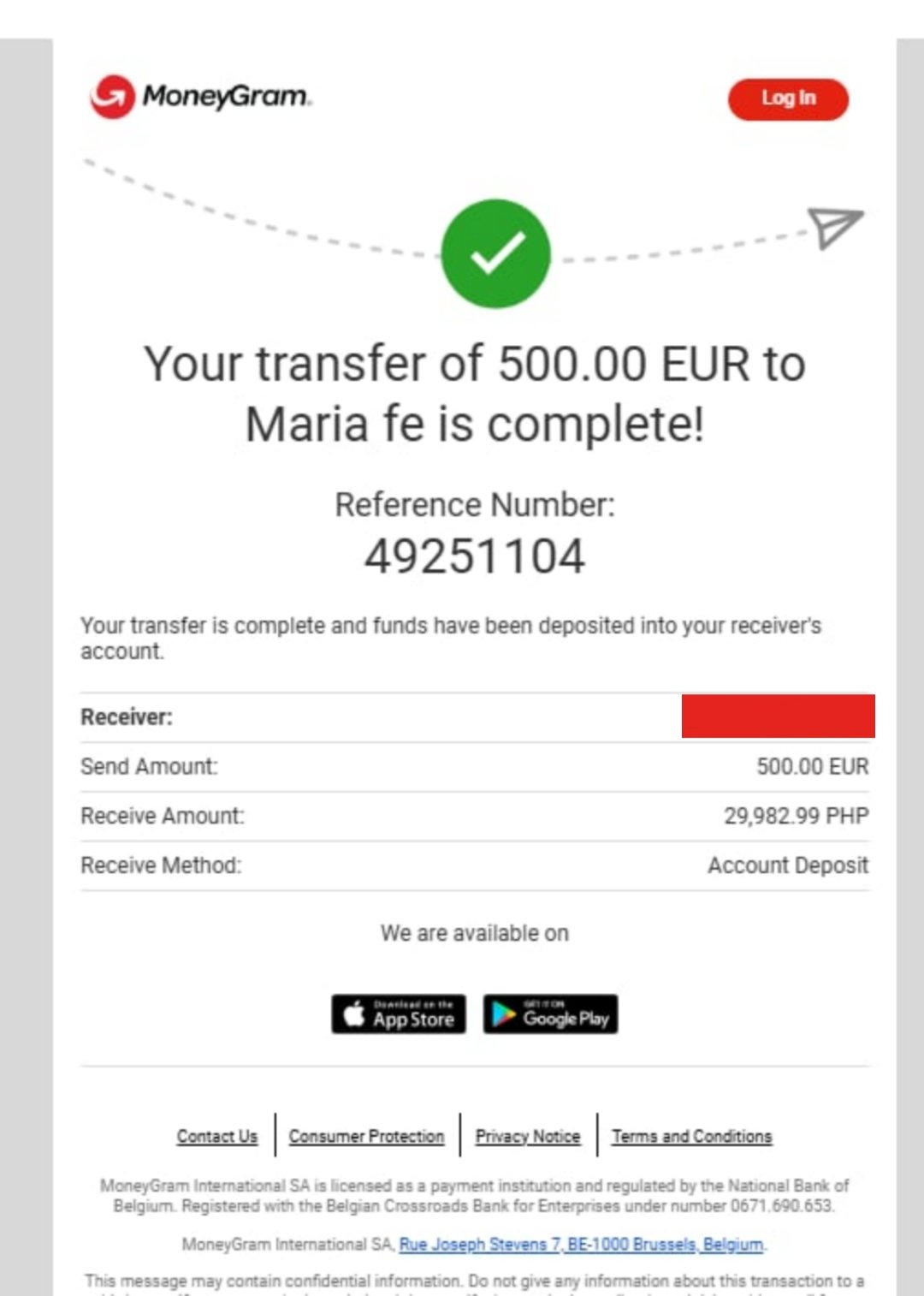

A “proof of payment” is a document or record that serves as verifiable evidence that a payment has been made for a service, product, or debt, typically including details like the date, amount paid, and payment method, and commonly taking the form of a receipt or bank statement confirming the transaction occurred; essentially, it’s a way to demonstrate that a financial transaction was completed successfully.

- Common forms:

- Receipts: Printed or digital receipts from a purchase, including details like the date, amount paid, and item description.

- Bank statements: Extracts from a bank account showing a completed transaction with the date, amount, and payment recipient.

- Credit card statements: Online or paper statements detailing a credit card charge.

- Wire transfer confirmations: Documentation confirming a successful electronic funds transfer.

- Cancelled checks: A check with the bank’s cancellation stamp indicating it has been processed.

- Receipts: Printed or digital receipts from a purchase, including details like the date, amount paid, and item description.

What is proof of delivery?

The main different types of POD are:

- A physical signature on a paper document

- A photograph

- A digital signature

- A digital receipt created in a software-based tracking system, perhaps using barcodes or QR codes